direct vs indirect cash flow forecasting

Reason being that the direct method provides information which may be useful in estimating future cash flows of an entity which helps the users in their decision making for eg for estimating the market value of an entity for estimating the future liquidity position etc. The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities.

How Direct Cash Flow Models Help Predict Liquidity Wsj

While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

. The indirect method is widely used by many businesses. Alternatively the direct method begins with the cash amounts received and paid out by your business. Direct method touted as best way to forecast cash flow The traditional indirect method while necessary for financial reporting isnt well-suited for planning finance specialists say.

This then helps you identify your businesss net cash flow from operating activities. The indirect method begins with your net income. The direct and indirect methods of cash flow forecasting affect the cash from operating activities section of cash flows and not cash from investing activities or.

These are called the direct and indirect method of cash flow forecasting. Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to determine not only the net cash flows by type of activity but also. The direct method includes all types of transactions including credit and cash transactions as well as bills invoices and tax.

It offers investors and other stakeholders a clear picture of all the transactions taking place and the overall health of. The indirect method which is best for longer terms uses. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. The direct and the indirect methods.

The main difference between the two methods relates to the cash flows from the operating activities. In the case of direct cash flow methods changes in cash payments are reported in cash flows from the operating activities section. This then identifies your operating cash flow.

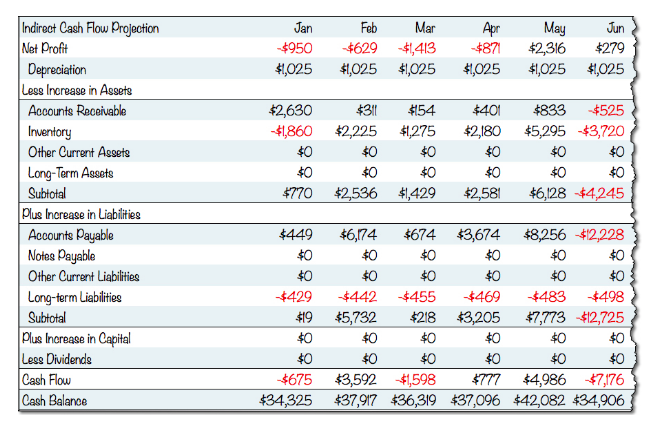

Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances of a company and predicts where a company is heading. Whats the difference between indirect and direct cash flow forecasting. The indirect method which is best for longer terms uses forecasts from other financial statements.

Main Difference between Direct and Indirect Method of SCF. A cash flow statement is one of the most important tools you have when managing your firms finances. The direct method ideal for shorter periods identifies all likely future inflows and outflows.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your accounting software. Whereas the direct method involves collecting information from bank transactions minusing cash income from cash expenditure to reveal your cash flow. Generally there are two categories of.

As the forecast is based on predicted actuals it creates more accuracy especially in the shorter-term. The latter method starts from the statement of income as if it were on a cash basis. Such information is not available under the indirect method.

Generally there are two categories of cash flow forecasting techniques. Two main approaches exist in constructing a statement of cash flows. You can perform a cash flow forecasting using either the direct or indirect method.

The former builds up net changes in cash flows by adding individual gross cash inflows and subtracting gross cash outflows. But in the interim the direct method produces the kind of forecast that decisions can be made. Indirect cash flow forecasting.

Building a cash flow statement with the indirect method Set up the statement. As you are simply making a few adjustments to one figure you can arrive at your final figure much quicker than the direct method. The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period.

Eventually youll need to switch to indirect cash flow forecasting as your company expands. In the case of an indirect cash flow method changes in assets and liabilities accounts are adjusted in the net income to replicate cash flows from. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

Up to 5 cash back 5411 Basic Concepts of the Two Methods. Forecast your future cash position and regain your control on your business finances. There are no differences in the cash flows from investing activities andor the cash flows from financing activities Under the US.

Direct cash flow forecasting. The indirect method of cash flow forecasting is more widely used amongst businesses. The direct and indirect methods of cash flow forecasting affect the cash from operating activities.

Which Cash Flow Method is Better. Actuals of both the direct and the indirect must match up.

Statement Of Cash Flows Significant Non Cash Activities Cash Flow Statement Accounting Classes Accounting And Finance

Statement Of Cash Flows Cash Flow Statement Positive Cash Flow Cash Flow

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect The Best Cash Flow Method Vena

Statement Of Cash Flows Direct Method Format Example Preparation

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Ias 7 Statement Of Cash Flow Summary Video Lecture Acca Online Accounting Teacher Cash Flow Cash Flow Statement Positive Cash Flow

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget